dependent care fsa vs tax credit

Ad Download or Email FSA004 More Fillable Forms Register and Subscribe Now. Get a free demo.

What Is A Dependent Care Fsa How Does It Work Ask Gusto

The child and dependent care tax credit.

. If you pay more than 6000 in childcare costs dont use the dependent care FSA take the credit. Easy implementation and comprehensive employee education available 247. The maximum credit for one child is 3000 per year or 6000 for two or more children not to exceed 6000.

Up to 25 cash back Instead the dependent care contribution is subtracted from the child care credit 3000 - 2000 1000 allowing you to claim a child care credit of 20 of 1000 amounting to 200. The Child and Dependent Care Credit must be. Dependent Care FSA.

With the dependent care FSA you can put away up to 5000 for daycare expenses. Dependent Care FSA vs Dependent Care Tax Credit. If you pay 6000 - 11000 in childcare costs you could put the difference between what you expect to pay in childcare costs and 6000 in a dependent care FSA.

You have another option for saving money on dependent care expenses via lowering your taxable income. The 20 credit would cut your tax bill by 1000 if you pay 5000 in child-care expenses for two kids. PdfFiller allows users to edit sign fill and share all type of documents online.

The child and dependent care tax credit covers similar expenses as the dependent care FSA. This will save you 5000 x 12 600 in federal income taxes plus 5000 x 765 FICA taxes 38250 so 98250 in taxes. The child tax credit is 3000 or 3600 for each child dependent on you claim on your tax return.

Row 23 original credit and 24 new credit provide 1500 and row 26 original child tax credit and row 27 new tax credit provide 3600. For examples if AGI is 100000 150000 and 200000 with one new born then. Child and dependent care tax credit.

The child must live in. Dependent Care FSA vs. If you have two or more children and your.

5000 is the maximum whether for one child or more. Typically 5000 for all tax filing status except married filing separately. Prior to the American Rescue Plan Act of 2021 the Dependent Care Tax Credit provided a maximum of 35 of eligible childcare expenses paid during the year as a tax credit.

The credit rate you can claim based on your income has increased. The expense limits are now 8000 for one dependent and 16000 for two dependents or more. Unlike the dependent care FSA however you dont need to apply for it through an employer.

Filers could claim up to 3000 of expenses for one child and up to 6000 for two or more resulting in a maximum available credit of 1050 and 2100 respectively. But there is a way to benefit from both options. Do you know about the changes to the Dependent Care FSA and the Dependent Care Tax.

Elevate your health benefits. The child care credit was increased for 2021 only. For 2021 the limit was increased to 10500 but raising the limit was left to each employers discretion.

The FSA saves you 20 state tax rate in taxes on 5k the credit returns 50 of expenses though expense amount is reduced by whatever you pay through the FSA. I changed row 6 Remaining DCFSA from 10500 to 5000. For the individual contributing to the Dependent Care FSA include all wages minus employee paid healthcare premiums and contributions.

Income Tax Credit. See the table below. The annual maximum pre-tax contribution may not exceed 5000 per year regardless of number of children.

Child and dependent care tax credit is a tax credit available to a person who is employed full-time and who maintains a household for a dependent child or a disabled spouse or dependentTax credit is the dollar for dollar reduction in the amount of taxes owed by a taxpayer. Youre spending twice that so no problem there. Rate decrease of 1 for every 2k.

The provisions relating to this are codified in 26 USCS 21. Even if things revert back to 2020 rules for dependent care expenses its close to a wash for the first 3k. For 2021 you could claim a child care credit of 50 of up to 8000 amounting to 4000.

Child Care Tax Credit. Similar to a DCFSA the credit only applies to expenses that are necessary for you to work unless youre disabled or a full-time student. AGI 100000 and DCSFSA row 5 with 5000 state CA.

The child and dependent care credit and the ability to use an FSA to pay child care expenses has different requirements. Ad Custom benefits solutions for your business needs. If you use the child and dependent care credit you can claim a tax credit for 25 based on.

This means that those who dont qualify for an FSA such as part-time employees can still take advantage of this tax credit. Both the FSA and the credit results in a 20 tax savings. Percentage 125000.

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Coronavirus And Dependent Care Fsa H R Block

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

What Is A Dependent Care Fsa Wex Inc

A Dependent Care Fsa Can Help You Save Money On Childcare Costs Here S What To Know

Tx302 Payroll Withholding Tax Essentials Payroll Taxes Payroll Medical Insurance

2021 Changes To Dcfsa Cdctc White Coat Investor

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Dependent Care Fsa Dcfsa Optum Financial

2021 Dependent Care Fsa Vs Dependent Care Tax Credit Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

2021 Dependent Care Fsa Vs Dependent Care Tax Credit Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

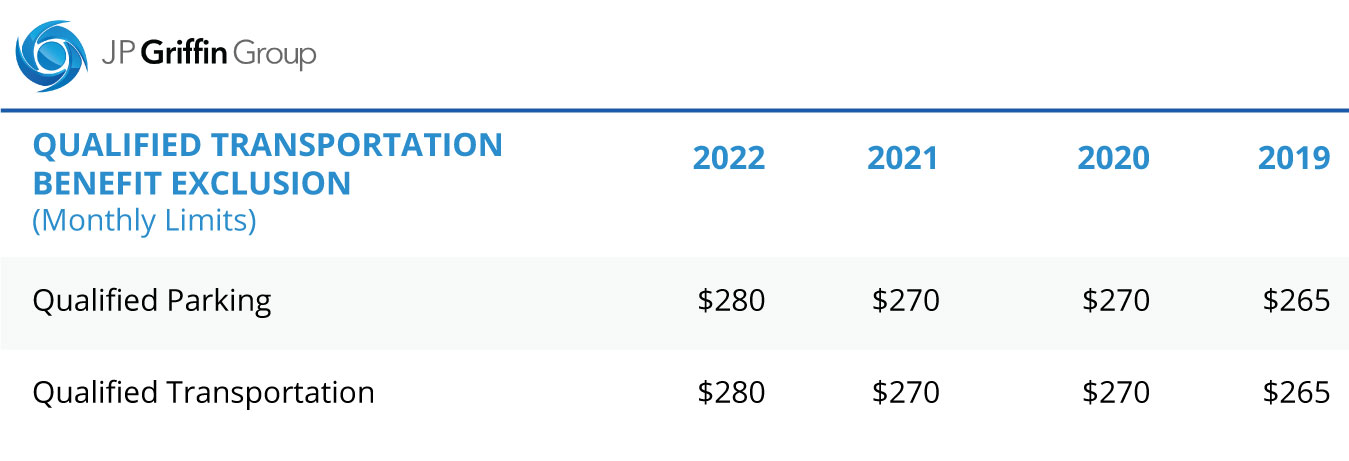

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

2021 Dependent Care Fsa Vs Dependent Care Tax Credit Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

How To Take Advantage Of The Expanded Tax Credit For Child Care Costs

Dependent Care Fsa Daycare Costs Affordable Daycare Christmas Savings